Message from BVI Financial Services Commission

May 2022

The Company is a BVI registered company under company registration number 1972633 but has never been registered and/or licensed by the BVI Financial Services Commission (the “Commission”) to conduct any type of financial services business from within or outside the Territory of the BVI. Please note, for a BVI company to conduct any type of financial services business, including investment business, the company is required to apply to the Commission and be approved to hold the requisite licence. We confirm that the Company is not and has never been registered or licensed by the Commission to carry on any type of financial services business from within or outside the Territory.

Additionally, please note that the Company has been struck from the register of companies with effect from 2nd November, 2021 as a result of its failure to pay its annual registration fees. On 9th March, 2022 the Company’s registered agent resigned. Under BVI laws, a company must at all times have a registered agent failing which it will be struck from the register. Whilst a company remains struck off, it is prohibited from carrying on any business and the company, its directors and members are prohibited from acting in any way in relation to the affairs of the company. A company which has been struck off is dissolved 7 years after the date of striking off.

In the event that shareholders wish to assert a claim to shares in a BVI company, or assets owned by a company which has been struck off, please note that an application to the Registrar to restore the company to the Register can be made by the company or a creditor, member (ie shareholder) or liquidator thereof. If this is the intention of the shareholders, we strongly advise that they consider taking independent legal advice on the steps to be taken to protect their legal rights and interests. A link to the list of BVI law firms authorized to practice can be found on the Commission’s website under the link to Non-Regulated Entities- https://www.bvifsc.vg/regulated-entities

Please note that extreme caution should be exercised before engaging in any financial transactions with the Company or any other company which purports to be carrying on financial services business; but which has not been licensed by the Commission.

Unfortunately, we are unable to assist you with obtaining the return of the money you may have already paid out to the Company, or with obtaining confirmation of the current shareholders of the Company, as that is outside the remit of the Commission. If you consider that the Company has been concerned in fraudulent transactions, you should consider reporting the matter to the law enforcement authority in your jurisdiction as we have no jurisdiction to conduct an investigation into allegations of fraud concerning the entity. As stated above, we strongly suggest that shareholders in the Company consider taking independent legal advice to protect their legal rights.

So What's Really Going On Here Now?

Most shareholders of New World Oil and Gas plc understandably but mistakenly thought that they had invested in an oil and gas exploration company. In fact they had invested in a Jersey (Channel Islands) Unregulated Exchange Traded Fund (UETF). UETFs were explained and Ministerially approved/justified at the time here :

"When funds go through

the portal, Jersey ADVISERS will ensure that the promoters are not INVOLVED IN MONEY LAUNDERING or have a REPUTATION FOR RECKLESSNESS.

Everyone who operates here wants to make sure the island maintains its REPUTATION.

"

Technical Director "Jersey Finance", run as a not-for-profit marketing organisation,

was formed to represent and promote Jersey as an international

financial centre of excellence and is funded by members of the local

finance industry and the

States of Jersey Government.

Introduced in 2008, by 2016 these UETFs had been recognised by the Jersey authorities as being open to misuse. Such misuse was determined to be bad for the image of "Jersey plc". They are therefore being phased out and no new UETFs will be registered.

Being no longer traded on AIM, NWOG couldn't remain as a UETF but JFSC (who are red hot on this - see below) decided to examine the company for compliance with Jersey money laundering regulations before allowing it to formally change its status as it is required to do if it doesn't resume secondary trading on a market. The resulting Public Statement, whose two pages took over seven months to write, can be found here together with a comment on the "Jersey Way" of dealing with issues of REPUTATION:

"At its heart is the Jersey Way. More than that, it is, as the

panel observed, expressly about the Jersey Way in its sinister,

controlling, ‘protection of powerful interests and resistance to change,

even when change is patently needed’ manifestation. There’s

much in the report to support this contention, not least the focus on

cover-up and the protection of the Island’s reputation. But the biggest

obstacle to true reform and progress is that the Jersey Way is

hard-wired into Jersey’s establishments".

Without naming or penalising anyone, JFSC concluded that from 2011 to February 2017 the Board of NWOG had failed to meet its legal responsibilities regarding monitoring and reporting of suspicious share transactions that might be related to money laundering. NWOG was directed to hold an EGM to decide what to do next. This addressed the need for a change in status or a resumption of Exchange trading somewhere and concluded that a change of status was necessary. Shareholders approved the proposal to change the name of the company, agreed it should revert to a holding company and agreed to the initiation of a move to the British Virgin Islands.

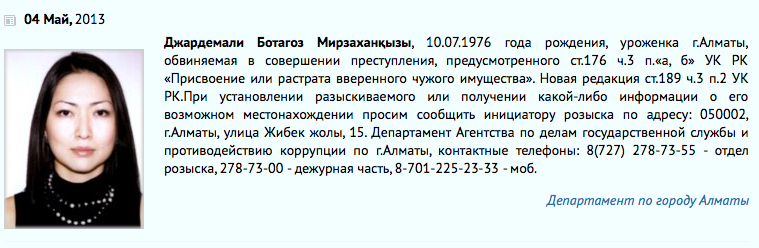

Shareholders will appreciate that advisors and directors appear to have failed to perform to the required standard of anti-money laundering processes until forced to do so by JFSC three months after de-listing from AIM. When thinking about NWOG and money laundering, shareholders should bear in mind the relationship between the Sztyk family and the Ablyazov Syndicate.